Warren Buffett Calculator 46

Paid Version

Publisher Description

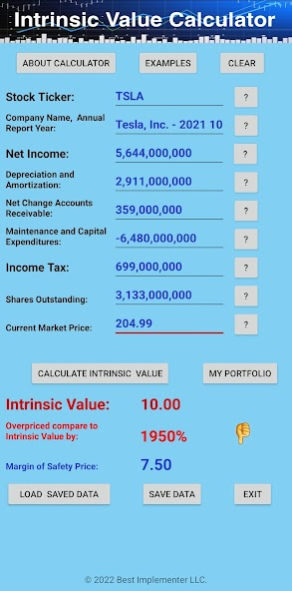

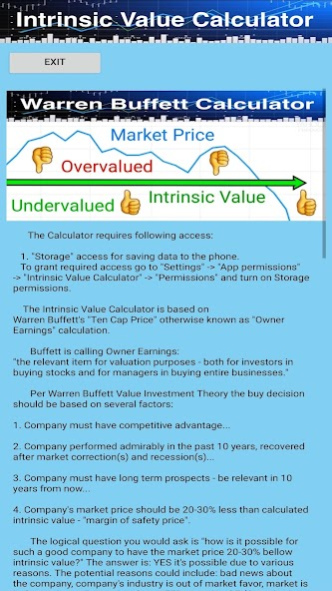

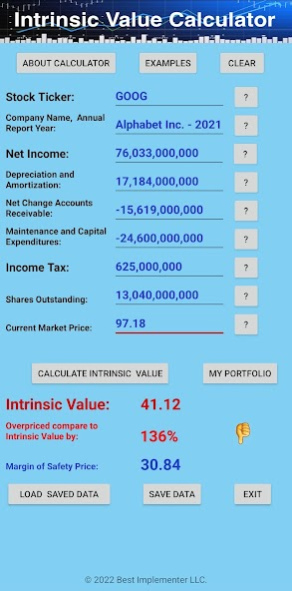

This Intrinsic Value Calculator is based on Warren Buffett "Ten Cap Price" otherwise known as "Owner Earnings" calculation. Buffett is calling Owner Earnings: "the relevant item for valuation purposes - both for investors in buying stocks and for managers in buying entire businesses."

Per Warren Buffett Value Investment Theory the buy decision should be based on several factors:

1. Company must have competitive advantage.

2. Company performed admirably in the past 10 years, recovered after market correction(s).

3. Company must have long term prospects - be relevant in 10 years from now.

4. Company's market price should be 20-30% less than calculated intrinsic value - margin of safety price.

The logical question you would ask is how is it possible for such a good company to have the market price 20-30% bellow intrinsic value? The answer is: YES it's possible due to various reasons. The potential reasons could include: bad news about the company, company's industry is out of market favor, market is in correction or recession.

All statistical data shows that we are in the biggest Stock Market Bubble in the history of the world! Bigger than "DOT-COM Bubble" of 2001 or "Housing Bubble" of 2008. It's just a matter of time before this Market Bubble is popped presenting an opportunity for Value Investors to buy their favorite stocks for less than intrinsic value! But in order to buy your favorite stocks for less than intrinsic value you need to know what this intrinsic value is. This is when our Intrinsic Value Calculator comes handy. You can calculate, store, reload and compare intrinsic value with market price anywhere and anytime, and all you need is your phone and our application.

You can read more about Value Investing online. We would recommend - "The Intelligent Investor" book written by Benjamin Graham - Warren Buffett's teacher and the founder of Value Investment Theory.

The goal of this application is to help value investors with calculation of intrinsic value. Most of the values required for calculation could be found on company's latest annual report. Annual reports can be found on company's website in investor relations section.

Each edit field has a corresponding help button to explain the meaning and location of the data on company's annual report.

"Examples" button would display Intrinsic Value for BAC, JPM, BABA, BIDU, TSLA and FAANG stocks: Meta Platforms, Apple, Amazon, Netflix and Alphabet’s Google. Based on calculated Intirnsic Value of these stocks we can conclude that current Stock Market BUBBLE should be called "FAANG Bubble".

"Save Data" button would save data to your phone storage at "IntrinsicValueData" folder as comma separated ".CSV" file.

"Load Saved Data" button would display list of files ".CSV" saved at "IntrinsicValueData" folder.

You can use this calculator literally anywhere, after all, it comes with your phone… It’s easy to use, all you need is to find and load annual report to your phone using internet browser as PDF file, search for required values, cut and paste values to the calculator and press Calculate button. Now you know if the stock is the bargain or overvalued based on company’s annual report and not on subjective calculations of various market analysts who could be biased based on their own long or short position on particular stock…

This calculator can be used at any country, any stock market and numbers can be presented in any currency. The only requirement: company must submit annual reports. Current users of this calculator are located in following countries:

United States

United Kingdom

Angola

Australia

Canada

Indonesia

India

Italy

Jamaica

Germany

Malaysia

Netherlands

New Zealand

Singapore

South Korea

Kenya

Qatar

you can learn more about warren buffett value investing by following this link ->

https://bestimplementer.com/value-investing-warren-buffet-strategy.html

© 2021 Best Implementer LLC

About Warren Buffett Calculator

Warren Buffett Calculator is a paid app for Android published in the Accounting & Finance list of apps, part of Business.

The company that develops Warren Buffett Calculator is DIY Implementer. The latest version released by its developer is 46.

To install Warren Buffett Calculator on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2023-06-12 and was downloaded 2 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the Warren Buffett Calculator as malware as malware if the download link to com.diyimplementer.yc.intrinsicvaluecalculator is broken.

How to install Warren Buffett Calculator on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the Warren Buffett Calculator is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by Warren Buffett Calculator will be shown. Click on Accept to continue the process.

- Warren Buffett Calculator will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.